Liberty Market Investment prop firm was registered in London in 2019 and has provided funded trading accounts ever since. The firm takes pride in its proposal of values which are clearly defined and there are no hidden fees and rules. The firm offers a VolFix trading platform with advanced functionality but has not disclosed whether they are partnering with any regulated broker.

In this Liberty Market Investment review, we will provide unbiased information about the firm’s crucial metrics such as safety, fees, funding options, platforms, and many more.

Pros & cons of Liberty Market Investment prop firm

Pros

- Ability to withdraw with $0 fees

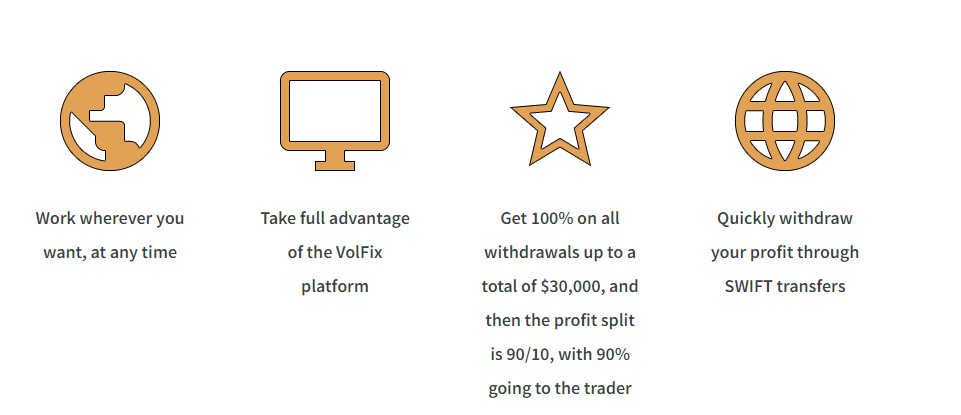

- Offers a profit-sharing ratio of 90%, after 100% for the first 30,000 USD

- Fast and digital account opening/verification

- Does not impose daily loss limits during the evaluation phase

- Most payment options are free and instant

Cons

- Lacks trader reviews and ratings on platforms like FPA

- No educational resources

- Monthly subscription fees

- Lack of phone support and live chat

Liberty Market Investment Quick Overview

| FPA Score | Not yet rated |

| Year founded | 10 Oct, 2019 |

| Headquarters | London, United Kingdom |

| Minimum audition fee | 140 USD |

| Fees on withdrawals | 0 USD |

| Minimum funded amount | 10,000 USD |

| Maximum funded amount | 150,000 USD |

| Allowed daily loss | 2.5% (0% during evaluation) |

| Profit target | 6% |

| Maximum trailing drawdown | 5% (3% during evaluation) |

| Profit sharing (Payouts) | 90% |

| Trading Platforms | VolFix |

| Available trading markets | Futures |

Safety of Liberty Market Investment – 1.5

The Liberty Market Investment reviews on the FPA are blank, as there are no comments from traders. As a result, the firm is not yet rated on the platform. This deducts 2 points from its safety evaluation, as this is one of the most important components of our evaluation. There is no broker involved in trading, and LMI offers access to the VolFix platform. The firm that offers this platform offers a simulated trading environment and price data feed and is not a broker, meaning LMI offers virtual trading without a regulated broker. The firm has been around since 2019 giving it a mild legitimacy, but is not enough to give the firm more than a 1.5 score.

Liberty Market Investment Funding and Maximum Capital Allocation – 3

Liberty Market Investment funded programs require two stages of evaluation before traders can get funded. The findings are different for each evaluation stage, including the funded trader period. LMI Liberty Market Investment funding list for the 1 Stage Program:

- Small – 30,000 USD

- Medium – 50,000 USD

- Large – 100,000 USD

- Max – 150,000 USD

Liberty Market Investment challenge funding amounts for the s Stage program:

- Mini – 10,000 USD

- Small – 30,000 USD

- Medium – 50,000 USD

- Large – 100,000 USD

- Max – 150,000 USD

Liberty Market Investment prop trading on the funded account offers the following funding options: 10,000 USD, 30,000 USD, 50,000 USD, 100,000 USD, and 150,000 USD.

Liberty Market Investment’s scaling plan only sets rules for maximum lot sizes and does not offer more funding even after hitting profit targets consistently.

We give the LMI a 3 score in this section.

Liberty Market Investment Assets – 2

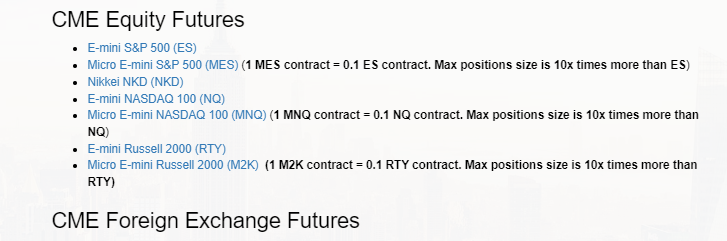

There are only futures for trading on the LMI platforms. The futures are diverse and include a wide variety of asset classes including Cryptocurrency futures, commodities futures, Equity futures, financial/interest rate futures, COMEX futures, and EUREX futures (only for EU trades).

Some of these futures are E-mini S&P 500, Micro E-mini S&P 500, Nikkei NKD, Micro E-mini NASDAQ, E-mini Russell 2000, Australian $, GBP, Euro FX, E-mini Euro FX, Micro Bitcoin, Gold, Silver, Crude oil, E-mini Crude Oil, and many more. All these assets are in the form of futures.

For offering only futures, but with diverse underlying assets, we give the firm a 2 score in this section. All trading positions on instruments ‘HE’, ‘LE’, ‘ZCC’, ‘ZW’, ‘ZS’, ‘ZM’, and ‘ZL’ must be closed 10 minutes before the end of the trading session. All other instruments will be closed by an automatic system.

Liberty Market Investment Trading rules and limitations – 1.4

Liberty Market Investment rules are similar to other prop firms and do not offer anything unique. The profit target varies depending on the trading accounts’ funded amounts and is between 6-6.6%. There is no daily loss limit, which is very advantageous for traders who employ riskier trading strategies during the evaluation phase. However, there is a daily loss limit when the trader becomes funded at 2.5%. The maximum trailing drawdown is 3-5% as it decreases for the higher funded accounts. When a trader becomes a funded trader, the maximum drawdown is 5%. There is a limited maximum position size of 3 lots. Breaking any rules and trading with more than the allowed maximum lot sizes will result in losing the funded account.

The firm gets a 1.4 score in this section.

Liberty Market Investment Fees – 1.5

An LMI 14-day free trial makes it possible to activate and test your trading skills on a virtual account, but there is a catch. Liberty Market Investment free trial will require monthly subscription fees for each funded account after the 14 days period, which are as follows:

SMALL funded account: 30,000 USD – 140 USD per month

MEDIUM funded account: 50,000 USD – 155 USD

LARGE funded account: 100,000 USD – 300 USD

MAX funded account: 150,000 USD – 350 USD

There is no Liberty Market Investment free repeat, as traders will have to pay decreased fees for restarting the account if they breach rules. These fees are:

- Medium: 50,000 USD account – 50 USD restart fee

- Large: 100,000 USD – 80 USD

- Max: 150,000 – 90 USD

These fees when used for restarting the account will not reset the monthly payment schedule periods.

We give the firm a 1.5 score in this section.

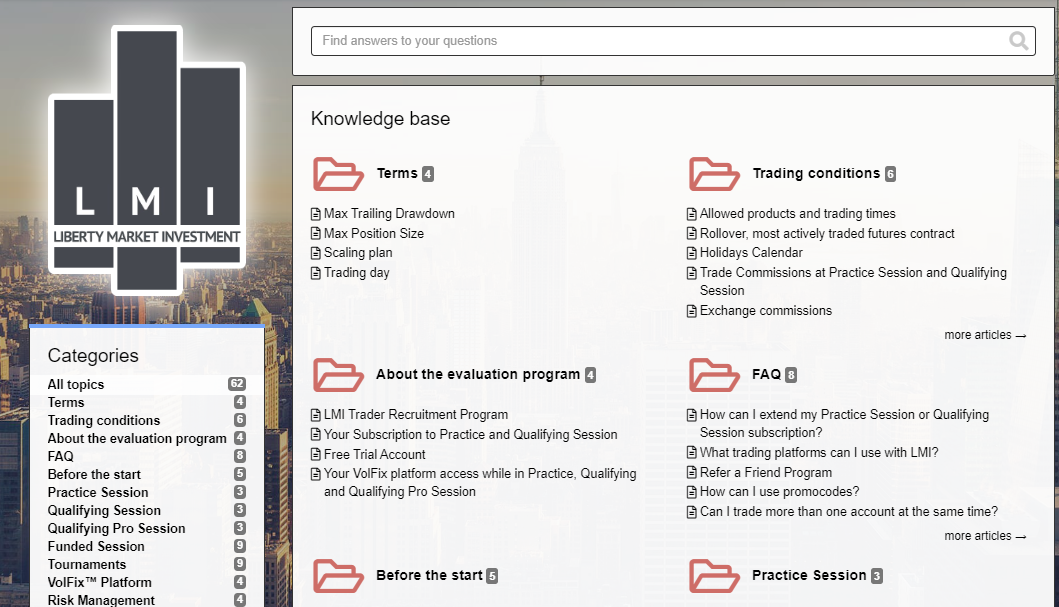

Liberty Market Investment Platforms – 2.4

LMI offers trading through the 3rd party trading platform VolFix which is provided by the technology company offering solely price data fee and a trading platform. This platform is advanced and offers diverse functionalities to show trader performance and offer charts and other data. However, this platform is not as advanced as other advanced platforms such as MT4 and MT5.

We give the LMI a 2.4 point in the platform section.

Liberty Market Investment Profit-Sharing – 3

Liberty Market Investment profit split is set to 90% after the first 30,000 USD withdrawal. The first 30,000 USD withdrawals are 100% going to traders. The firm uses swift bank transfers for withdrawals. This is a very good policy and definitely gives the firm a higher score in this section. The withdrawals are done through wire transfers, which usually take 5-6 business days.

Overall, we give the firm a 3 score in this section.

Education and trading tools at Liberty Market Investment – 1

There are no educational resources on the LMI website. However, there are plenty of trader performance measure plugins and apps in the VolFix platform. All the tools are offered through the dashboard and traders can always be in control of their risks and performance.

For lacking the educational resources, but providing performance measure tools, we give the firm a 1 score.

Customer Support at Liberty Market Investment – 2.8

There is an advanced help center on the website that offers all the information about the firm services. The section for the platform, however, lacks articles and indicates they are still working to offer tutorials for the platform and its functionality. There is only an email support option available. The firm lacks phone support and live chat. Both the website and support are offered in 5 different languages, giving the firm some score.

Overall, we give the firm a 2.8 score in this section.

Frequently Asked Questions

Is Liberty Market Investment legit?

Does Liberty Market Investment charge fees for withdrawals?

What educational resources does Liberty Market Investment provide?