Lepus Proprietary Trading prop firm is an Australian proprietary firm that offers funded accounts from 10,000 to up to 2 million Australian dollars. The firm also offers a training course for beginner traders, promising expert training and successful results. Its traders are working with contracts and the company claims not to be like a funding firm, but rather a true prop firm employing experienced traders.

In our Lepus Proprietary Trading review, our readers will discover the firm’s fees, safety, funding limits, rules, and many more.

Pros & cons of prop firm

Pros

- The firm has been in operation since 2013 and partners with a regulated broker

- Transparent Funding and Scaling Plan

- No Participation Fees, only a minimum deposit required

- Offers educational training provided by industry professionals

- Provides access to advanced MT4 platform

- No daily and maximum drawdown limits

- Most payment options are free and instant

Cons

- Lack of Discounts and Low Minimum Fee

- The minimum deposit amount is 2,000 AUD

- Limited Trading Instruments, no cryptos and stocks

Lepus Proprietary Trading Quick Overview

| FPA Score | Not yet rated |

| Year founded | 2013 |

| Headquarters | Melbourne, Australia |

| Minimum audition fee | 2,000 AUD |

| Fees on withdrawals | 0 USD |

| Minimum funded amount | 10,000 USD |

| Maximum funded amount | 2,000,000 USD |

| Allowed daily loss | None |

| Profit target | 2-4% per month |

| Maximum trailing drawdown | None |

| Profit sharing (Payouts) | 50% |

| Trading Platforms | MT4 |

| Available trading markets | Forex, indices, and commodities |

Safety of Lepus Proprietary Trading – 3

There are no Lepus Proprietary Trading reviews on the FPA platform at all, which is suspicious as the firm claims to have been on the market since 2013. There is no about us information, despite there being a button for it. The firm is based in Melbourne and could be overlooked by global traders. There are only 16 reviews on the Trustpilot, granting the firm a 4.5 rank. The partner broker of Lepus Proprietary Trading is OX Securities, an ASIC-regulated Forex broker.

The firm gets a 3 score in this section as it has both experience and a regulated broker partner, but lacks an FPA rating.

Funding and maximum capital allocation – 4

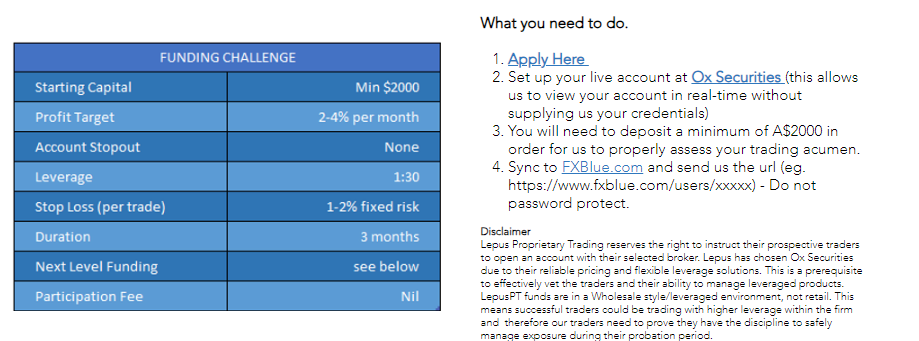

Lepus Proprietary Trading funded program consists of one challenge which starts from 2,000 USD and has a 3 months duration. This lack of diversity may seem disadvantageous at first, but is very comfortable and offers preferable rules and flexible funding options.

Lepus Proprietary Trading funding is also subject to transparent rules and limitations and has a well-defined and reasonable scaling plan.

Lepus Proprietary Trading scaling plan is divided into 6 different levels and is activated every time a trader reaches the corresponding profit target on their funded accounts every three months.

Lepus Proprietary Trading challenge scaling has the following levels and corresponding funding:

- Level 1 – 10,000 AUD (Australian Dollar)

- Level 2 – 40,000 AUD

- Level 3 – 150,000 AUD

- Level 4 – 450,000 AUD

- Level 5 – 750,000 AUD

- Level 6 – 2,000,000 AUD

Traders have to go through a briefing with the CEO of the Lepus Proprietary Trading firm to discuss the exact conditions of the trading such as max stop, risk amount, max exposure, target, and leverage.

The firm gets a well-deserved 4 score in this section.

Lepus Proprietary Trading Assets – 3

Traders can choose between Forex, indices, and commodities on the MT4 platform provided by the firm’s partner broker OX Securities, which is a regulated broker. The maximum leverage is capped at 1:30 which is reasonable and should be enough, especially at higher funding levels.

The firm gets only a 3 score in this section as it lacks stocks and cryptos.

Lepus Proprietary Trading rules and limitations – 3.4

Lepus Proprietary Trading rules are very transparent and clearly given on the website. Here is the exact rules list:

- Profit target – 2-4% per month

- Account stop out – None

- Maximum leverage – 1:30

- Stop loss per trade – 1-2% fixed risk

- Time limits and duration – 3 months

- Maximum allowed drawdown – None

- Max open trades – 5

Despite the rules being simple with a super low-profit target, there is a twist. The trader needs to deposit the minimum amount of 2,000 AUD on the funded account and show their performance during 3 months evaluation period, after which they can start scaling their funding with the firm’s money.

The firm gets a 3.4 score in this section for having very flexible rules, but not allowing trading during weekends and News.

Lepus Proprietary Trading Fees – 2.5

There are no participation fees involved, as the Lepus Proprietary Trading firm evaluates traders based on their own real money to check their trading performance when there is money on the line.

Lepus Proprietary Trading free repeat means the trader has to deposit the funds again if they lose all of their real money during the first three months. As such, there are no daily and maximum drawdown limits, as traders trade with their own money.

Lepus Proprietary Trading free trial is not available at the moment as there is only one funded account which requires traders to deposit their money.

The firm gets only a 2.5 score in this section, as it lacks both discounts and a minimum fee of below 150 USD.

Lepus Proprietary Trading Platforms – 5

OX Securities, the partner broker of the Lepus Proprietary Trading firm, offers access to an advanced MT4 trading platform. There are plenty of tutorials available on the Ox securities broker website for the MT4 platform. It comes with all the functionality of standard MT4, including built-in indicators and automated trading capabilities.

The firm gets a 5 score in this section.

Lepus Proprietary Trading Profit-Sharing – 1

Lepus Proprietary Trading’s profit split is at 50% all the time. After a trader shows their performance, the firm CEO discusses trading details and conditions with the trader and the firm activates a scaling plan. At all levels, the profit share stays at 50%.

Since there is no possibility to go beyond the 50% mark, we give the firm a 1 score in this section.

Education and trading tools at Lepus Proprietary Trading – 2

The firm offers dedicated educational training with industry professionals. In fact, the firm is both an educational and funded trading platform. These courses are paid and there are no free educational resources, but it seems pro trading course and should enable beginners to start profitable trading. There are no video tutorials, webinars, or seminars freely available and all courses are paid starting from 1,800 USD.

The tools for trader’s performance are available on the dashboard and allow them to monitor their risks and other stats.

We give the firm a 2 score in this section.

Customer Support at Lepus Proprietary Trading – 2.6

There are only phone and email support options given on the website of Lepus Proprietary Trading, and they are only in the English language. The website is also available in a single language, and offers no diversity in this regard. The firm is represented on social media, including Instagram and Facebook. The lack of live chat is a huge disadvantage for the firm.

We give the firm a 2.6 score in this section.

Frequently Asked Questions

Is Lepus Proprietary Trading legit?

What is the profit-sharing ratio at Lepus Proprietary Trading?

Does Lepus Proprietary Trading offer free educational resources?