FTUK or Forex Traders UK is a Forex proprietary firm allowing traders to get funded accounts ranging from 14k to 5M USD. The firm got rebranded recently and is now fully operational as an FTUK offering diverse assets and two funded account types. Despite being new, there are plenty of positive comments online. The profit share is at 80% and the maximum leverage is set at 1:100. The funding accounts are divided into levels and traders have to complete each level to get a scaling plan going.

In our FTUK review, we will focus on the most essential specs including safety, fees, funding, rules and limitations, and many more.

Pros & cons of FTUK prop firm

Pros

- Ability to withdraw with $0 fees

- Offers access to MetaTrader 4, MetaTrader 5

- Fast and digital account opening/verification

- Offers access to diverse markets including Forex, indices, commodities, and digital currencies

- Allows holding of open positions during overnight and weekends

- There are no daily loss limits

- Most payment options are free and instant

Cons

- Higher actual profit target of 10% on all accounts and levels (the company claims 8%)

- Very low leverage of 1:10 on lower levels of funding

- FTUK is not transparent about its allowed daily loss limits

FTUK Quick Overview

| FPA Score | Not yet ranked (2 reviews) |

| Year founded | 2021 |

| Headquarters | Dubai, United Arab Emirates |

| Minimum audition fee | 149 USD |

| Fees on withdrawals | 0 USD |

| Minimum funded amount | 14,000 USD |

| Maximum funded amount | 90,000 USD (Up to 5M USD with scaling plan) |

| Allowed daily loss | None |

| Profit target | 10% actual (the firm claims it to be 8%, but is actually 10% on all levels) |

| Maximum trailing drawdown | 8% |

| Profit sharing (Payouts) | 80% |

| Trading Platforms | MT4, MT5 |

| Available trading markets | Forex, commodities, indices, and cryptocurrencies |

Safety of FTUK – 1.5

There are only two comments on the FPA platform about the firm. Despite having zero evaluation at the moment, the FTUK scam is not confirmed. Since one comment was mildly negative and the second positive, which was not enough to evaluate the firm, we have checked the Trustpilot rankings of the firm. The prop firm has a 4.2 ranking score on Trustpilot from 170 plus reviews. This is an excellent score for any company and could indicate that FTUK is a legitimate and reliable prop firm. FTUK reviews at Trustpilot are mostly positive, as the firm is not hasty to block trader accounts for soft breaches like not having the proper stop loss.

The EightCap Forex broker who is the main partner of the FTUK is also a regulated broker which increases the safety of traders. However, the firm was rebranded in 2022 and was established in 2021 making it a relatively young prop firm.

Overall, for not having more than 3 years of experience and no FPA evaluation, we give FTUK 1.5 points in safety.

Funding and maximum capital allocation at FTUK – 4

There are two ways of getting FTUK funding, one is through an evaluation program and another way is through an instant funding program.

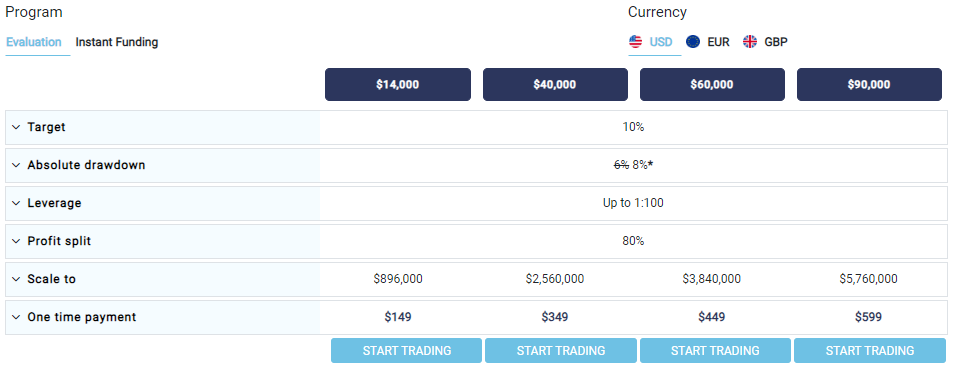

The evaluation program consists of a single-phased process where traders have to show they can manage large capital profitably, without breaching risk management and other rules. The funding capital structure is similar for both evaluation and instant programs. The funding ranges from 14,000 USD up to 90,000 USD. When selecting the evaluation program, traders are given demo trading accounts where they have to show profitable performance. Sign-up fees start from 149 USD for the lowest funded amount of 14,000 USD.

For the instant funding program, traders start on the live account and can start earning profits from day one. Both evaluation and instant funding programs allow holding open positions overnight and over the weekends. There are no time limits and the FTUK scaling plan is available.

FTUK prop trading funding can be scaled to up to 5 million USD. Here is the exact scaling plan by FTUK:

- Funded account 14,000 USD – scales up to 896,000 USD

- Funded account 40,000 USD – scales up to 2,560,000 USD

- Funded account 60,000 USD – scales up to 3,840,000 USD

- Funded account 90,000 USD – scales up to 5,760,000 USD

Unfortunately, the FTUK free trial is not available at the moment.

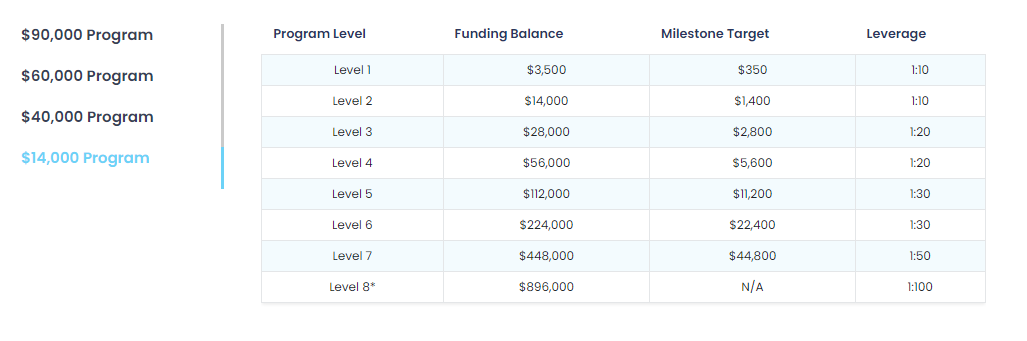

Both funded accounts allow traders to withdraw funds from level 2, meaning the holders of the instant funded accounts still have to make it to level 2. This is not consistent with the firm claiming instant profit withdrawals from day one. A little red flag here for sure. So, how does the leveling system work at FTUK? For each funded amount, there are different levels, meaning traders have to hit certain profits before they can withdraw profits. For example, if a trader goes for the 14,000 USD account which is the small one, they receive a 3,500 USD account instead. They will have to make 350 USD profits to proceed to level 2. The leverage during levels 1 and 2 is just 1:10. After completing level one, traders get a 14,000 USD account and are required to make 1,400 USD profits. So, the actual profit target is not 8% for beginners but 10% instead!

FTUK funded programs in general are very similar to each other and offer slight differences. We will talk more about the rules and limits in the below sections.

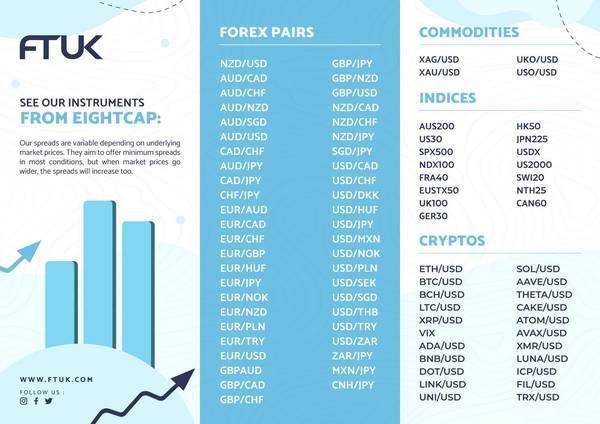

FTUK Assets – 3.5

All popular asset classes including FX pairs, cryptos, indices, and metals are available on MT4 and MT5 of EightCap. The broker is the main partner of FTUK and is a regulated Forex and CFDs broker. From FX pairs there are majors, minors, and some exotics offered for low spreads and commissions. Unfortunately, there are only commodities available, gold and silver at the moment. More than 11 cryptos should be sufficient for crypto enthusiasts. There are no stocks available for trading at the moment, unfortunately.

The leverage system with FTUK is counterintuitive, and it increases as the traders progress to higher levels and get more funding. It should be higher on lower levels with account funding of 14,000 USD and lower, but the company decided to give lower accounts lower leverage limits of 1:10 and 1:100 only accounts above 800k. Here is the leverage system for each level:

- Level 1 and 2 – 1:10

- Level 3 and 4 – 1:20

- Level 5 and 6 – 1:30

- Level 7 – 1:50

- Level 8 – 1:100 (level 8 is only available through add-on purchase)

The reason this is counterintuitive is that lower amounts will require higher leverage to make profits relevant and easily achievable, instead, FTUK decided to ensure traders will not hit profit targets easily.

For lacking stocks and other trading instruments, FTUK gets 3.5 points in the assets section.

FTUK Trading rules and limitations – 3.8

Here comes the most important section of evaluating how reliable the FTUK prop firm is. The same rules apply to both Evaluation and instant funding programs.

The profit target for each funding level is 8%, the maximum leverage on Forex pairs is set at 1:100, profit split is 80%. The absolute maximum drawdown is at 8%.

Traders must set a stop loss of a maximum of 1.5%, or they get their open position closed immediately. This is called the soft breaches by the FTUK and traders must pay close attention every time they open a position. FTUK free repeat is not available, and it is super critical to follow all the rules outlined by the firm.

We give FTUK in this section 3.8 points, as the firm has a 10% profit target and lacks a few other minor metrics.

FTUK Fees – 5

The fees start from 149 USD, which is competitive for a 14,000 USD account. Here is the full list of funding and their respective fees for instant account types:

- 14,000 USD funding accounts – 200 USD fee

- 40,000 USD funding accounts – 550 USD fee

- 60,000 USD funding accounts – 750 USD fee

- 90,000 USD funding accounts – 1,200 USD fee

The fee structure is a bit different for the evaluation funding accounts:

- 14,000 USD funding accounts – 149 USD fee

- 40,000 USD funding accounts – 349 USD fee

- 60,000 USD funding accounts – 449 USD fee

- 90,000 USD funding accounts – 599 USD fee

As we can see, evaluation funding accounts require cheaper fees than instant accounts, making them more desirable for beginners with a small budget and little experience. There are no FTUK challenge accounts at this point, only the evaluation one is accessible.

The spreads are low on EightCap MT4 and MT5 platforms from 0 pips, and the same is true for commissions.

A minimum fee of 149 USD, 0 pips spreads, 0 fees on withdrawals, and allowing withdrawals within 1-2 business days lets FTUK get 5 scores in the fees section.

FTUK Platforms – 5

FTUK provides access to advanced platforms MT4 and MT5 through their partner broker EightCap. The broker is regulated and offers both platforms for free. Apart from the multitude of inbuilt indicators and tools, neither the firm nor the broker offers any advanced tools and plugins.

Despite lacking some bonus custom plugins, both MT4 and MT5 are available on all devices and offer full functionality to trade without limits, we give FTUK a 5 score in this section.

FTUK Profit-Sharing – 3

FTUK profit split is at 80% for all accounts on all levels. This is very competitive and within the industry standards. Having the ability to get 80% of profits made on multiple million-dollar accounts gives traders greater flexibility to achieve financial goals.

If the FTUK offered a profit share of up to 90% it would get 5 scores in this section.

Education and trading tools at FTUK – 0

There are no educational resources on FTUK whatsoever. No webinars, courses, video tutorials, or even articles to help traders learn to trade.

There are no market research or trader performance measuring tools available either, making the score for FTUK 0 in this section.

Customer Support at FTUK – 2.4

FTUK prop firm support consists of live chat and email support. There is no phone support. Neither the website nor the live chat is multilingual and only supports the English language. This lack of phone support is characteristic of prop firms, but we still evaluate it as a red flag. The live chat is very comfortable at FTUK and the firm’s representatives are responsive and polite. We got all the answers quickly from the support.

As a result, we give the firm 2.4 in this section.

Frequently Asked Questions

Is FTUK legit?

What is the profit-sharing arrangement at FTUK?

What are the fees associated with FTUK's prop trading program?