Forex Prop Firm offers funded accounts to Forex, stocks, cryptos, commodities, and indices traders through regulated brokers. The firm has been around for a while now, which increases its legitimacy. The maximum funding amount is 200,000 USD, which can be scaled up to 10 million USD through the firm’s scaling plan.

In this Forex Prop Firm review, our readers will get essential details to define if the Forex Prop Firm review scam is possible and whether they can trust the firm’s claims.

Pros & cons of Forex Prop Firm

Pros

- Ability to withdraw with $0 fees

- Offers access to MetaTrader 4, MetaTrader 5

- Fast and digital account opening/verification

- Offers access to diverse trading asset classes including Forex, crypto, indices, commodities, and stocks

- Up to 40% off on 25k and 50k funded accounts

- No lot size restriction for traders

- Most payment options are free and instant

- Positive customer reviews on Trustpilot 4.6

Cons

- The lowest audition fee starts from 189 USD

- Lack of FPA evaluation and ranking

- Profit-sharing claims of up to 100% raise suspicions

- Limited educational resources and trading tools

- Withdrawal restrictions, with profits locked for the first 30 days

Forex Prop Firm Quick Overview

| FPA Score | Not yet evaluated |

| Year founded | Unknown (at least from 2015) |

| Headquarters | Quebec, Canada |

| Minimum audition fee | 189 USD |

| Fees on withdrawals | 0 USD |

| Minimum funded amount | 10,000 USD |

| Maximum funded amount | 200,000 USD (10,000,000 USD with scaling plan) |

| Allowed daily loss | 5% (depending on the account type) |

| Profit target | 10% |

| Maximum trailing drawdown | 10% |

| Profit sharing (Payouts) | Up to 90% (10% during the evaluation phase) |

| Trading Platforms | MT4, MT5 |

| Available trading markets | Commodities, Forex, Indices & Stocks |

Safety of Forex Prop Firm – 3

There are no reviews and evaluations on the FPA. However, Forex Prop Firm reviews on Trustpilot are excellent and the majority of traders positively evaluate the firm. The score is 4.6 from more than 500 reviews. The partner broker of the firm is a regulated EightCap. The firm has been around for a while, as the earliest comment from clients we found was from 2015.

The firm gets a 3 score in this section for lacking the FPA ranking.

Forex Prop Firm Funding and Maximum Capital Allocation – 4

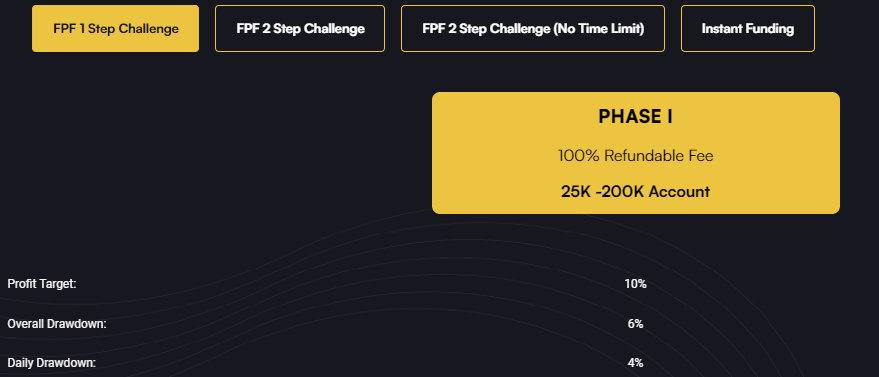

There are four different funded account types at Forex Prop Firm FPF: 1 Step Challenge, FPF 2 Step Challenge, FPF 2 Step Challenge (Without time limits), and Instant Funding accounts. Each of these accounts has slightly different requirements and funding structure.

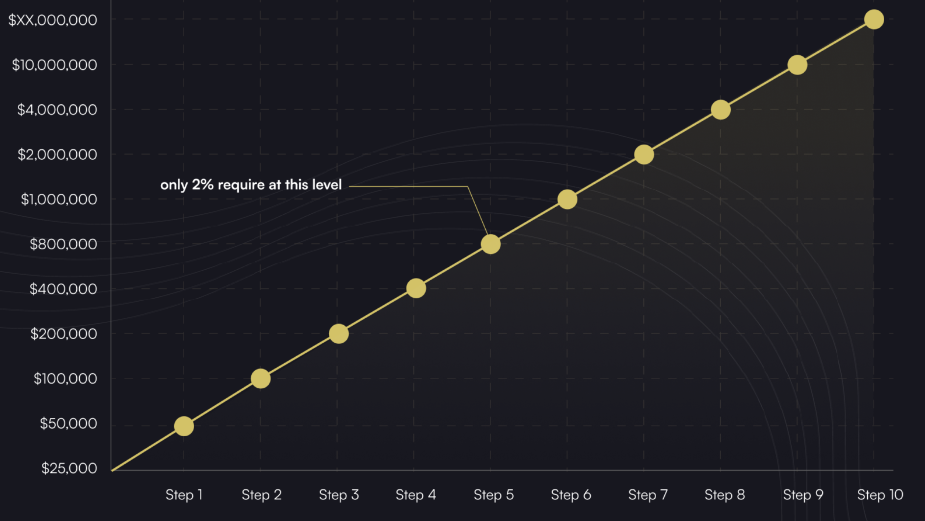

The first three accounts’ funding varies between 25k and 200k, while the minimum funding on the Instant Funding accounts starts from just 10k and goes up to 200k. These are starting funding amounts, and the firm has additional scaling policies.

The Forex Prop Firm scaling plan allows traders to get up to 10,000,0000 USD funded accounts.

FPF 1 Step Challenge requires a step evaluation process to get funded, and both the evaluation phase and the funded phase have similar requirements.

Forex Prop Firm challenges seem competitive and in line with the industry standards, and we give the firm a 4 score in this section. The firm would get a 5 score if they had funded accounts from 1,000 USD.

Forex Prop Firm Assets – 4.5

Forex pairs, commodities, indices, cryptos, and stocks can all be traded through the EightCap MT4 and MT5 platforms. The broker which is the main partner of the Forex Prop Firm is a well-regulated and legit entity.

The maximum leverage is different for each asset class. Forex can be traded with 1:30 leverage, cryptos for 1:10, and stocks with 1:5. While 1:30 is a bit restrictive for FX pairs, 1:5 leverage for stocks is very competitive.

Since the firm offers most of the asset classes, including stocks, we give it a 4.5 score in this section.

Forex Prop Firm Trading rules and limitations – 3.4

The rules depend on the funded account type and phase the trader is in.

FPF 1 Step Challenge requirements are as follows:

- Profit Target – 10%

- Overall Drawdown – 6%

- Daily Drawdown – 4%

- Minimum Trading Days – None

- Maximum Trading Days – None

- Platform – MT4, MT5

- Trading Restrictions – None

- Profit Split During Evaluation – 10%

- EA’s, Signals, Overnight & Weekend Position(s) Accepted – Allowed

- Profit Split – 90%

FPF 2 Step Challenge comes with the following limits and rules for Phase 1 and Phase 2:

- Profit Target – 8%, 5%

- Overall Drawdown – 12%

- Daily Drawdown – None

- Minimum Trading Days – 5

- Maximum Trading Days – 35, 60

- Platform – MT4, MT5

- Trading Restrictions – None

- Profit Split During Evaluation – 10%

- EA’s, Signals, Overnight & Weekend Position(s) Accepted – Allowed

- Profit Split – 90%

FPF 2 Step Challenge (Without time limits) comes with different rules:

- Profit Target – 10%, 5%

- Overall Drawdown – 10%

- Daily Drawdown – 5%

- Minimum Trading Days – 3

- Maximum Trading Days – None

- Platform – MT4, MT5

- Trading Restrictions – None

- Profit Split During Evaluation – 10%

- EA’s, Signals, Overnight & Weekend Position(s) Accepted – Allowed

- Profit Split – 90%

Instant Funding accounts also have slightly different rules and funded amounts:

- Starting Funding – 10,000 USD – 200,000 USD

- Minimum withdrawable profits – 5%

- Overall Drawdown – 5%

- Daily drawdown – 5%

- Minimum Simulated Trading Days – 5

- EA’s, Signals, Overnight & Weekend Position(s) Accepted – Allowed

- Virtual Profit Split Funded Account – 80% (up to 100%)

There is no lot size restriction, and the maximum lot size is solely for the trader to decide. We give the firm a 3.4 score in this section. The firm lost the majority of points for offering strict daily losses.

Forex Prop Firm Fees – 3.5

When it comes to spreads and commissions, EightCap offers very competitive conditions. We have checked their spreads, and they offer 0 pips spreads on major Forex pairs.

The minimum audition fees start from 189 USD for 10,000 USD accounts.

There are up to 40% discounts for challenge programs and traders can get it from the firm’s telegram channel.

Withdrawals are not charged, which is advantageous for traders.

We evaluate Forex Prop Firm Fees with a 3.5 score.

Forex Prop Firm Platforms – 5

Since the main pattern of the firm is EightCap which is a regulated broker, the firm offers access to the broker’s MT4 and MT5 advanced trading platforms. Both of these platforms offer full trading and market analysis functionality and can be used to trade both manually and automatically. Platforms are accessible on both Desktop and mobile platforms, together with web traders.

We evaluate the firm’s platforms with a 5 score.

Forex Prop Firm Profit-Sharing – 1

The official profit split level is set at 90% and the firm claims to be giving up to 100% profits to traders through their scaling plan. This is suspicious, as a profit split must be the main source of income for an honest prop firm. So, a red flag here is obvious.

Profits can be withdrawn when traders hit 5% profit on their funded account. Profit withdrawals are locked for the first 30 days, which is very restrictive. Withdrawals are paid out twice per month on the 1st and 16th days and traders can request directly from their dashboard. Payment methods accepted include PayPal, WISE, and bank cards.

We give the firm a 1 score in this section for its restrictions, tricky policies, and exaggerated claims.

Education and trading tools at Forex Prop Firm – 0

There are no educational materials on the website of Forex Prop Firm, but a blog. However, this blog is not even educational but more like a promotional tool for the firm. These posts are not educational, as they only promote how other traders made profits and withdrew money from the platform.

For lacking everything educational, including market research and trader performance tools, the firm gets a 0 score in this section.

Customer Support at Forex Prop Firm – 2.4

Customer support is provided through advanced live chat, which can be accessed from the website and offers advanced functionality to even browse a help center. Another support option is only email support. There is no phone support available. Both the website and support are only in English.

Since the firm lacks a hotline and multilingual support, we give it a 2.4 score in this section.

Frequently Asked Questions

Is Forex Prop Firm legit?

Does Forex Prop Firm offer educational resources?

What Are the Leverage Limits at Forex Prop Firm?