Blue Guardian is a prop firm based in the United Kingdom. The firm started in 2019 as a signal provider and later rebranded in 2022 as a prop firm allowing traders to trade on diverse assets. The firm allows traders to get funded accounts ranging from 10,000 USD to 200,000 USD and the smallest fee starts from 87 USD. These are the smallest fees we have found so far, and this is why we decided to take a closer look at Blue Guardian and evaluate if the company is this reliable and attractive.

Pros & cons of Blue Guardian prop firm

Pros

- Ability to withdraw with $0 fees

- Offers access to MetaTrader 4

- Fast and digital account opening/verification

- Offers access to diverse trading assets

- No profit target on funded accounts after the audition

- Offers up to 85% profit split

- Most payment options are free and instant

- Very low fee for funded accounts starting from 87 USD

Cons

- There are no FPA rankings yet

Blue Guardian Quick Overview

| FPA Score | Not yet available |

| Year founded | 2019 |

| Headquarters | Solihull, West Midlands, England |

| Minimum audition fee | 87 USD |

| Fees on withdrawals | 0 USD |

| Minimum funded amount | 10,000 USD |

| Maximum funded amount | 200,000 USD |

| Allowed daily loss | 4% |

| Profit target | 8% on 1st and 4% on 2nd phase |

| Maximum trailing drawdown | 8% |

| Profit sharing (Payouts) | 85% |

| Trading Platforms | MetaTrader 4 |

| Available trading markets | FX, FX Exotics, Indices, Gold & Commodities, and Cryptos |

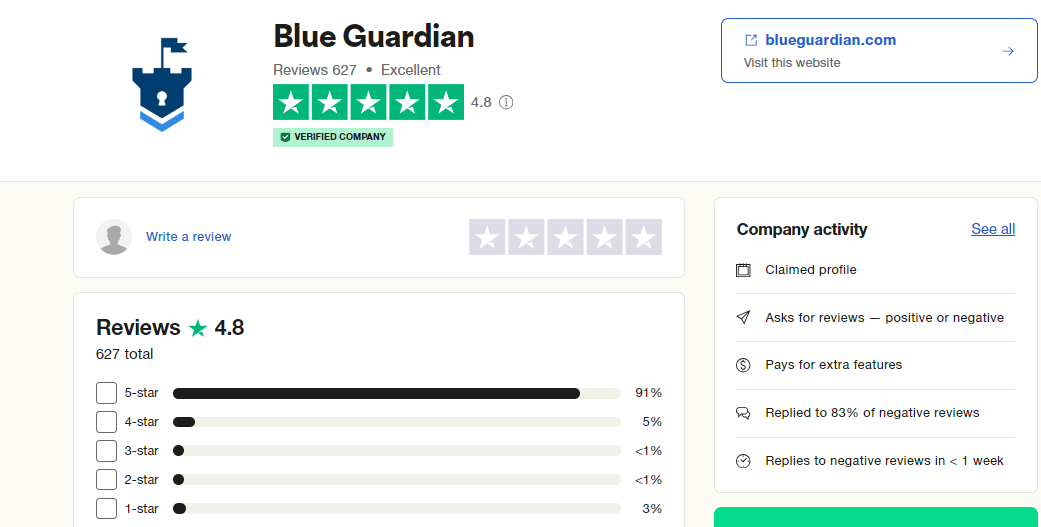

Safety of Blue Guardian – 3

Unfortunately, there are no reviews and evaluations about Blue Guardian on the FPA, which does not allow us to give the firm a high score. However, there are more than plenty of positive comments and feedback on Trustpilot, where the company accomplished a 4.8 score. As the prop firms are not required to be regulated like brokers are, it is crucial to collect online data from reliable platforms.

As a result, the firm gets a 3 score in this section.

Blue Guardian Funding and Maximum Capital Allocation – 3

The firm offers flexible funding options ranging from 10,000 USD to 200,000 USD. There are also 25k, 50k, and 100k funded accounts offered. The funded audition fees also vary from 87 USD for a 10k account to 947 USD for a 200k funded account. These are the cheapest fees to start trading on large trading accounts.

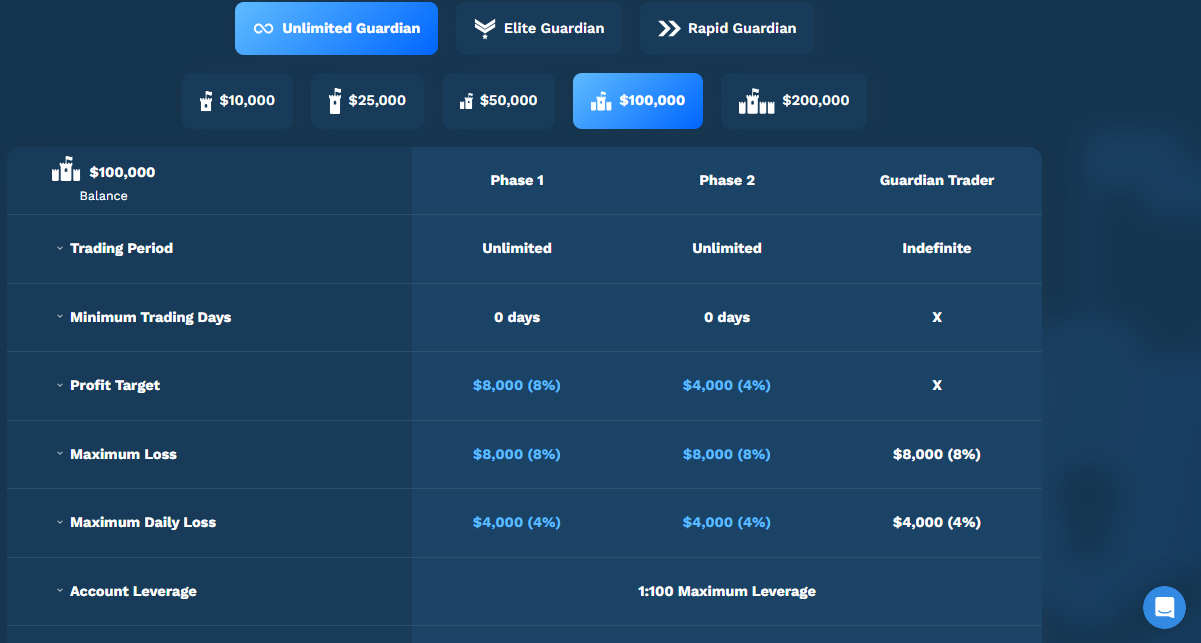

Before traders can start trading on the funded accounts, there are several steps or phases to complete. Each of these steps often comes with slight differences in the profit target. The first phase usually requires an 8% profit target goal, while the second phase requires only half that amount. For the third step, there is no profit target requirement, meaning in this phase traders already can start trading and making profits for withdrawals. Speaking of withdrawals, it is possible to get 85% of profits made through trading on funded accounts. This is a very competitive profit split. While not as high as a 90% profit split, which some popular prop firms are offering, Blue Guardian’s 85% profit share is still more than enough to make a living out of trading on funded accounts.

There are three types of funded accounts, Unlimited Guardian, Elite Guardian, and Rapid Guardian.

The unlimited guardian starts from an 87 USD fee on a 10,000 USD account, elite from 120 USD, and rapid from 97 USD.

We give the firm 3 in this section as well due to the lack of 1,000 and 1M funding.

Blue Guardian Assets – 4

One important aspect of trading with funded accounts is the diversity of trading asset classes the firm offers. Funded traders at Blue Guardian can trade a diverse list of assets including FX, FX Exotics, Indices, Gold & Commodities, and Cryptos.

Together with asset class diversity, leverage is also crucial in trading, and Blue Guardian offers up to 1:100 leverage. Traders can trade potentially 100 times their funded account on Forex pairs, which is very flexible. With high leverage and diverse assets, Blue Guardian’s tradable instruments are well within the industry standards.

Apart from the maximum leverage for FX being 100, there are different limits for unlimited and elite funded accounts. Starting on the Unlimited funded accounts, the maximum leverage for FX pairs is at 1:100, for indices 1:20, commodities 1:20, and cryptos 1:2.

The leverage limits are different for the Elite accounts. For FX trading the maximum leverage is 1:50, indices 1:20, commodities 1:20, and cryptos 1:2.

The broker providing Blue Guardian with trading software and environment is EightCap which is regulated by Australian ASIC making it a safe choice.

Since there are no stocks offered at this moment, Blue Guardian gets a 4 score here.

Trading rules and limitations at Blue Guardian – 5

Rules and limits are probably the most important part of any prop firm’s proposal, which every trader needs to check carefully. Before you decide if Blue Guardian is a reliable prop firm, here are the most critical limitations and requirements.

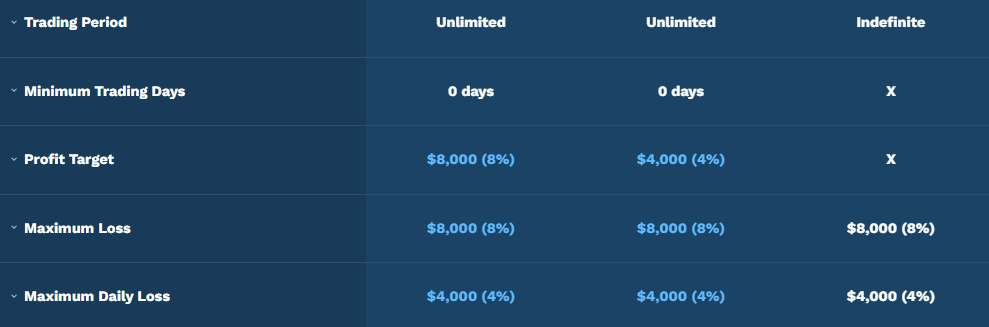

Since there are three different types of funded account classes, let’s explain each of them.

Unlimited Guardian offers the lowest fees and requirements are as follows:

- Trading period – unlimited.

- Minimum trading days – 0 days, indefinite (trader phase)

- Profit target – 8% (1st phase), 4% (2nd phase), none (Guardian trader)

- Maximum loss – 8% at all stages and phases

- Maximum daily loss – 4% for all stages

- Account leverage – 1:100 for FX pairs

- Profit split – 85%

- Refundable fee – 87 USD (1st phase), free (2nd phase)

For the Elite Guardian funded account class, there are slightly different terms:

- Trading period – unlimited.

- Minimum trading days – 5 days, indefinite (trader phase)

- Profit target – 8% (1st phase), 4% (2nd phase), none (Guardian trader)

- Maximum loss – 10% at all stages and phases

- Maximum daily loss – 4% for all stages

- Account leverage – 1:50 for FX pairs

- Profit split – 85%

- Refundable fee – 120 USD (1st phase), free (2nd phase)

The Rapid Guardian allows traders to become funded after only completing phase 1 of the audition. The specs for the final type of funded accounts called Rapid Guardian are as follows:

- Trading period – unlimited.

- Minimum trading days – 0 days

- Profit target -10%, none (Guardian trader)

- Maximum loss – 6% at all stages and phases

- Maximum daily loss – 4% for all stages

- Account leverage – 1:100 for FX pairs

- Profit split – 85%

- Refundable fee – 97 USD (1st phase), free (2nd phase)

Low fees and less restrictive rules do not allow us to give the firm a lower than 5 score in this section.

Blue Guardian Fees – 4

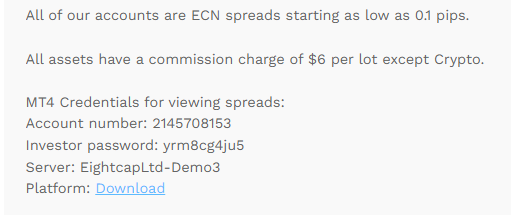

The firm is very attractive with its low fees starting from 87 USD for the lowest funded account of 10,000 USD. Apart from these low audition fees, the spreads are also low, starting from 0.1 pips on FX pairs. This is because the prop firm offers EightCap ECN accounts, which are known for their low spreads. All assets have a trading commission of 6 USD per lot round turn, except digital currencies.

Although spreads start from 0.1 pips, they are not 0 pips, and we give the firm a 4 score here.

Blue Guardian Platforms – 5

EightCap, the broker for which Blue Guardian has a contract, offers an MT4 advanced trading platform. Blue Guardian MT4 offers advanced functionality as it supports both manual and automatic trading and comes with plenty of in-built indicators. It is possible to install custom indicators and trade. One-click trading is not allowed and traders will have to use a lengthy process. This is because it is not allowed to trade without stopping loss.

It is also possible to use demo credentials on the MT4 to review full spreads for each offered trading asset, which is a little quality of life addition.

Blue Guardian deserves a 5 score here as MT4 comes with all features and support.

Blue Guardian Profit-Sharing – 5

Blue Guardian indeed offers one of the best policies for profit sharing. 85% of all profits is trader’s and the firm does not offer any profit target restrictions which is super attractive.

Before traders can get to this phase, they need to complete a two-phase audition and meet the profit target with specified risks. After two phases are completed and the trader starts trading on the funded account they paid for, they become free to withdraw at any point and get 85% of profits. Surely, it is only possible to withdraw profits and not the funded capital itself. This is no restriction on the profit targets after becoming the funded trader is the main advantage of the Blue Guardian prop firm.

Profit-sharing policies are top-notch at Blue Guardian, and we evaluate this section with a 5 score.

Education and trading tools at Blue Guardian – 2

Since Blue Guardian offers funded accounts only, there are no advanced educational resources or materials at the moment. There is a blog, but it has only one post that explains how to use the company’s tool Guardian Protector.

As for trading tools, Blue Guardian assists their traders by introducing a Guardian Protector. This plugin ensures that traders never lose more than the allowed daily loss limit. The tool similarly to other tools can be found on the dashboard after opening an account.

The lack of educational resources does not let us give the firm a higher score here, 2 points in this section.

Customer Support at Blue Guardian – 4

When it comes to customer support, Blue Guardian offers excellent service via live chat. Representatives answer inquiries quickly and know details about the firm’s products. Other forms of support, email, and phone support are also available. An extensive FAQ section offers answers to the majority of questions about every detail of the prop firm.

The only downside of the Blue Guardian support is the lack of multilingual support. All support is available only in English at the moment.

The only thing preventing the firm from getting a 5 score here is the lack of multilingual support with more than 5 languages.

Frequently Asked Questions

Is Blue Guardian a good prop firm?

What are the key features of Blue Guardian's trading accounts?

How Does Blue Guardian Ensure Account Security?